Survey: Mandatory Digital Payment Options, Receipt Issuance, and Tax Fraud

Shopping, for instance at the supermarket, is a universal everyday experience. At the checkout, it’s always the same routine: Cash or card? Do you want the receipt? Behind these simple questions lies a complex system of legal requirements – and it's currently in flux. The coalition agreement of the German federal government outlines several upcoming changes: a mandatory digital payment option, the abolition of the receipt issuance obligation, and a future obligation to use electronic point-of-sale (POS) systems.

Germany at the Checkout:

A representative survey commissioned by fiskaly examines how the German public views these proposed changes. The survey was conducted by the market research institute Appinio.

Survey results:

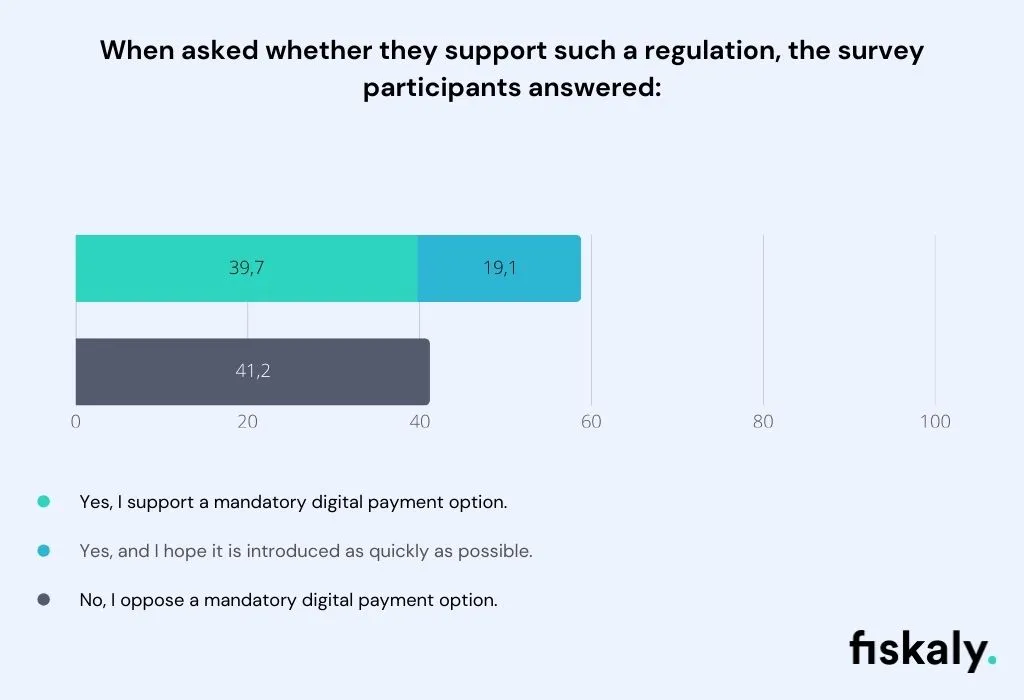

Mandatory digital payment option: Majority in favor – especially younger people

A total of 58.8% of respondents are in favor of the mandatory introduction of digital payment options—39.7% of them in principle, with a further 19.1% even advocating implementation as soon as possible. However, 41.2% of respondents reject a legal obligation. Particularly striking is that approval is especially high among younger people:

- Age 16–24: 53.9% in favor, additional 18.2% want fast implementation

- Age 25–34: 50.5% in favor, additional 20.1% want fast implementation

Digital payment and receipt issuance: Two-thirds aware of anti-tax fraud purpose

Germany’s Federal Audit Office estimates that the government loses up to €70 billion annually to tax evasion – often due to poorly maintained or manipulated registers. To address this, fiscalization laws have been introduced in Germany and many other European countries. Germany’s "receipt obligation" is part of this framework, alongside digital payments. Receipts and card payments are more than a convenience – they’re essential audit tools. However, one-third of respondents were unaware of this fact, raising questions about the need for greater public awareness.

Background on receipt obligation, criticism, and digital alternatives

Why was the receipt obligation introduced in the first place? Since 2020, all POS transactions must be documented by receipts—regardless of whether customers want them. This obligation is part of the Cash Register Security Regulation (KassenSichV) and serves as a control mechanism: a mandatory receipt ensures that transactions are actually recorded and not bypassed by the system and only processed upon request. However, the receipt obligation, especially with paper receipts, has received criticism.

Oliver Abl, Country Manager fiskaly Germany:

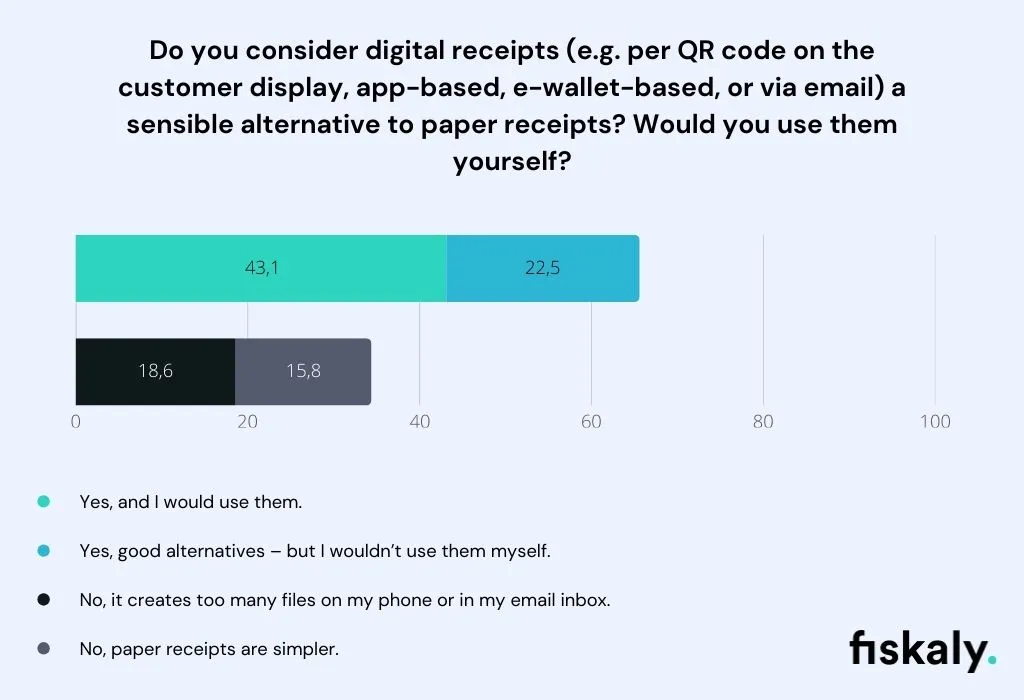

We understand the criticism of paper receipts – they create waste and consume resources. But mandatory, visible, and verifiable receipts are a key pillar in the fight against tax fraud. Without a receipt, a loophole opens. In this context, digital receipts are the solution and are met with broad acceptance (65,6%): They can be displayed without creating waste, and customers can decide whether they want to receive the receipt – for instance, directly on their smartphone. A paper receipt can still be provided if desired. There’s nothing preventing a fast rollout – several providers in Germany already offer cost-effective, easily integrated digital receipt options for existing POS systems.