Electronic receipts without the requirement of a telematic register: the new era in Italy

2024 is shaping up to be a pivotal year in Italy for the transition to a fully digital and cloud-based tax system, thanks to significant new regulations that will directly impact the field of telematic receipts.

This regulatory reform is the result of years of discussion and technological developments and reflects the growing need for more efficient and flexible solutions for managing business activities, as well as the need to align the Italian context with the European standards on cloud taxation and digitalization.

What is the regulatory context behind full digitalization?

The regulatory shift toward complete digitalization stems from the legislative decree of January 1, 2024, focused on simplifying tax compliance. This decree officially introduces the possibility of using a fully software-based tool for transmitting telematic receipts and issuing the commercial document (known until 2019 as the electronic receipt).

Italy had already begun this journey in 2019, when the commercial document and telematic cash registers became mandatory. Since then, merchants have been required to send their receipts to the Italian Tax Authority through certified devices. Today, with the new regulatory framework, software-based solutions pave the way for a decisive step toward full digitalization of the tax system.

In the past, this obligation required the purchase and maintenance of specific devices, resulting in costs and complexity that were not always aligned with the needs of all businesses.

In the coming months, thanks to the new regulations, companies will finally be able to opt for certified software solutions, such as fiskaly SIGN IT, which will provide greater flexibility and reduce operational costs associated with managing tax obligations.

Benefits of software solutions compared to using Telematic Registers

Transitioning from the use of a physical telematic register to telematic transmission software not only simplifies the daily management of operations but also opens new possibilities for innovation and the integration of other digital services and systems. But what are the features and advantages of this solution compared to traditional physical registers?

-

Cost reduction

- Adopting a tax software solution eliminates the need to purchase a telematic cash register. Buying an RT is not only a significant initial investment but also requires regular maintenance, which may include part replacement, hardware upgrades, and technical support. With tax software solutions, maintenance and upgrade costs are drastically reduced or completely eliminated, as everything is managed at the software level, and there is no need for physical intervention on a hardware device.

-

Greater flexibility & scalability

- A software for the management and transmission of telematic receipts can be easily integrated with existing management systems, offering greater flexibility in the daily management of activities and logistics as well as centralized, transparent, and accurate management of tax operations. For example, receipt data can be automatically synchronized with accounting software or other management systems, simplifying financial management, ensuring tax compliance, and reducing the risk of manual errors or communication omissions. This enables process automation, improves sales performance, and allows more precise and real-time control of tax compliance, as well as a smoother user experience for customers.

-

Tax compliance & Regulatory updates

- Working with a software provider like fiskaly ensure constant and timely updates to comply with the ever-changing regulations and requirements for receipts. This reduces the risk of data entry errors, omissions, or penalties due to missed system updates, which can be more complicated to handle with traditional telematic registers that require in-person technical intervention, potential slowing down of activities, and sometimes, the replacement of the device itself or some of its components.

-

Ease of use & accessibility

- The usability of a software solution is generally higher compared to traditional systems dependent on hardware. Switching to a tax software solution means having leaner and easier-to-use logistics and operational management compared to that of a traditional cash register. Furthermore, software like our fiskaly SIGN IT solution, served via API, can be used on any type of device, such as tablets, computers, or smartphones, allowing for simple implementation suitable for any type of infrastructure or cash system used. Whether a small business or a large chain of stores, tax software can be easily scaled according to transaction volume and integrated with other business systems, such as warehouse management or accounting software.

What are the timelines, and how to prepare to adopt a cloud fiscalization software?

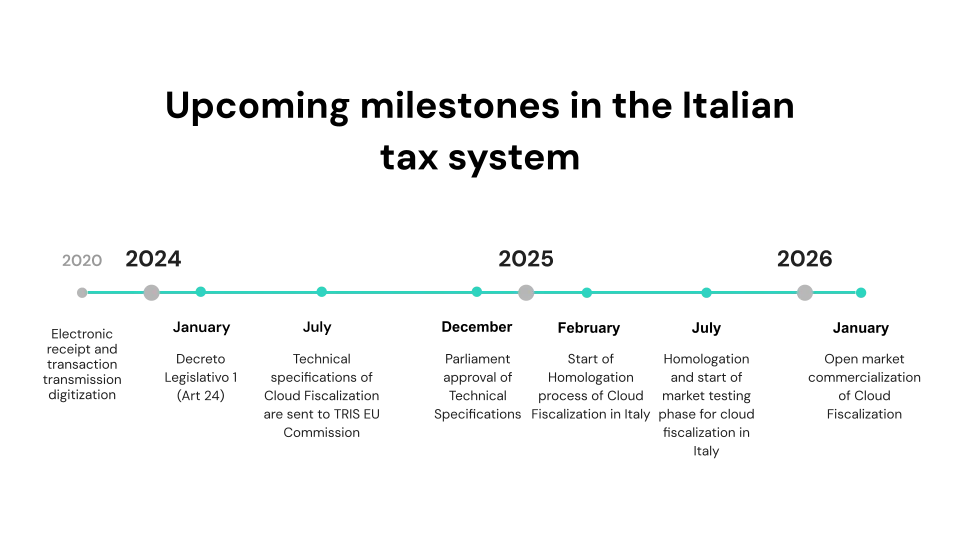

Although the new regulation is expected to come into effect in November 2024, the true large-scale adoption of software-based solutions is projected for 2026, following a series of measures and clarifications from the Italian Tax Authority.

This transition period allows POS system manufacturers and merchants to gradually adapt to the new requirements, giving them the necessary time to explore and choose the solution best suited to their needs.

At the same time, it enables the Italian Tax Authority to certify and test the fiscal software solutions proposed by providers (such as fiskaly), in line with the new technical specifications for the telematic transmission of receipts, which are currently under review by the Privacy Authority and the European Commission.

In line with this schedule, fiskaly will release new software for the management and transmission of telematic receipts in the first months of 2025, ensuring that Italian companies are ready to fully exploit the benefits offered by the new regulation.

For those who do not want to wait until 2025 to discover the advantages of a software solution for telematic receipts, at fiskaly we offer our fiscal solution fiskaly SIGN IT lite, which presents some differences compared to the solution being released in 2025 while is still fully compliant with the current tax regulations and allows full operation regarding receipt issuance and receipt transmission.

As always, our goal is to provide an easy-to-use, secure solution in full compliance with the new laws, allowing merchants to focus on their core business without worrying about tax management. fiskaly is part of the working group established by the Revenue Agency with the main Italian associations and has been able to provide feedback and have visibility into the process of defining the technical specifications of the software data storage solutions that will be introduced this year.

The provisions and technical specifications of the new software tool for receipt transmission proposed by the Revenue Agency have been made public by submitting them for the TRIS procedure to the European Commission and are available for consultation.

With fiskaly SIGN IT, businesses can confidently face the challenges of the digital future while ensuring compliance with tax regulations.

If you want to learn more about how fiskaly can help your business navigate the new regulatory framework of 2024, don't hesitate to contact us. We are here to guide you towards a simpler and more digital future and support businesses operating in Italy through this transition.