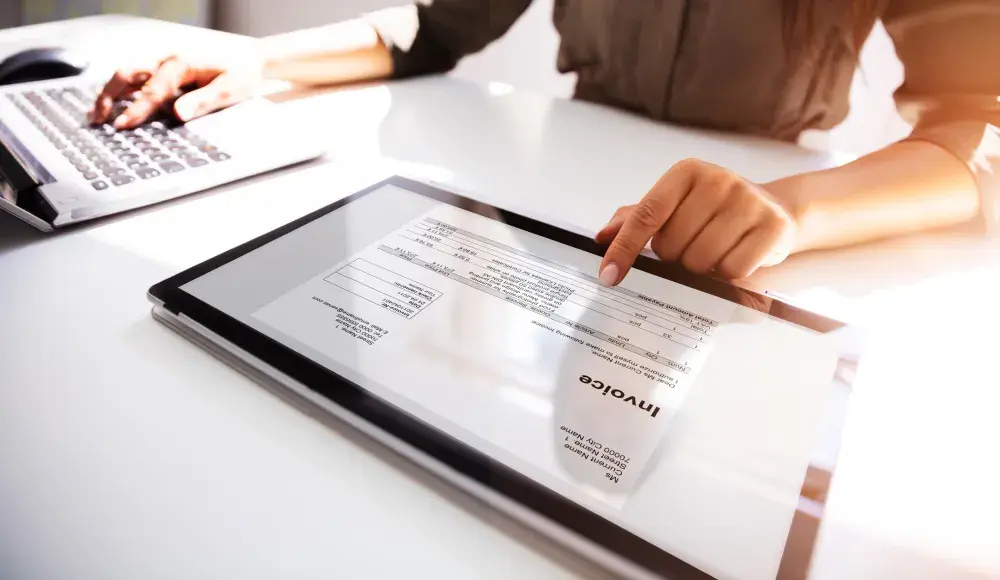

Why do you need aTicketBAI API?

TicketBAI (TBAI) is the tax regulation applicable in the Basque Country, obligatory for companies of all sectors and sizes with tax headquarters in Bizkaia, Araba, and Gipuzkoa.

SIGN ES features

By integrating a single API, you will automatically comply with TicketBAI, the Anti-Fraud Law (VeriFactu) and Crea y Crece Law (B2B e-invoice).

We have developed a validation process to avoid file rejection. Convenient and error-free.

Sign, chain and send the XML files to the Basque Tax Authorities in real-time. 100% confidential.

Filter and export your invoices with just one click, accessible through both the API and our SIGN dashboard.

Automatically generates the required codes on each invoice in accordance with the regulations.

If your system experiences a temporary loss of connection or faces connectivity issues, don’t worry! We've got you covered.

TicketBAI FAQs

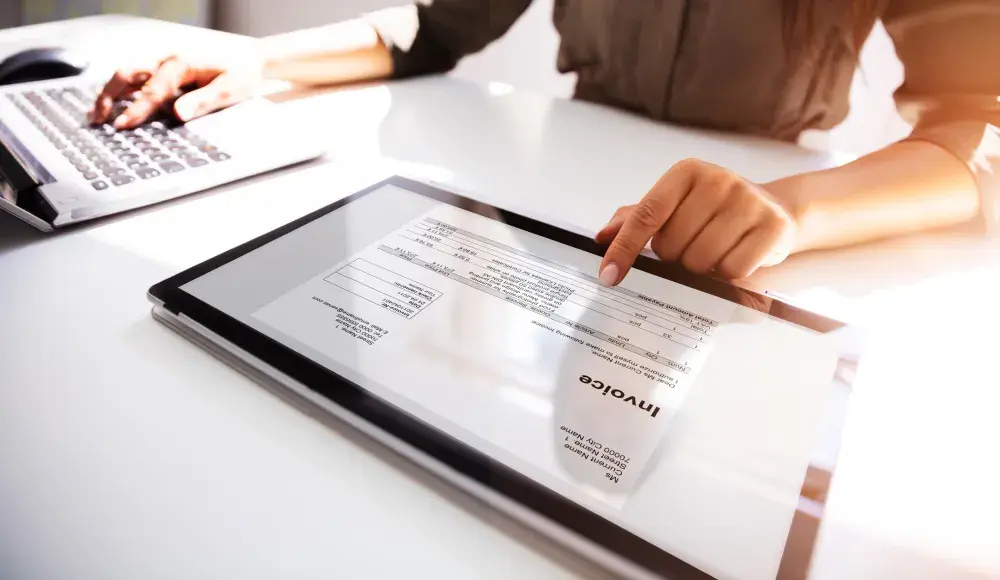

Interested? Request a first meeting

- We're here to help with any questions and find the perfect solution.

- Over 1,600 customers trust our fiscalization solutions. We've got you covered!

Latest news about TicketBAI

All blog posts

Biscay extends TicketBAI implementation period to 2026