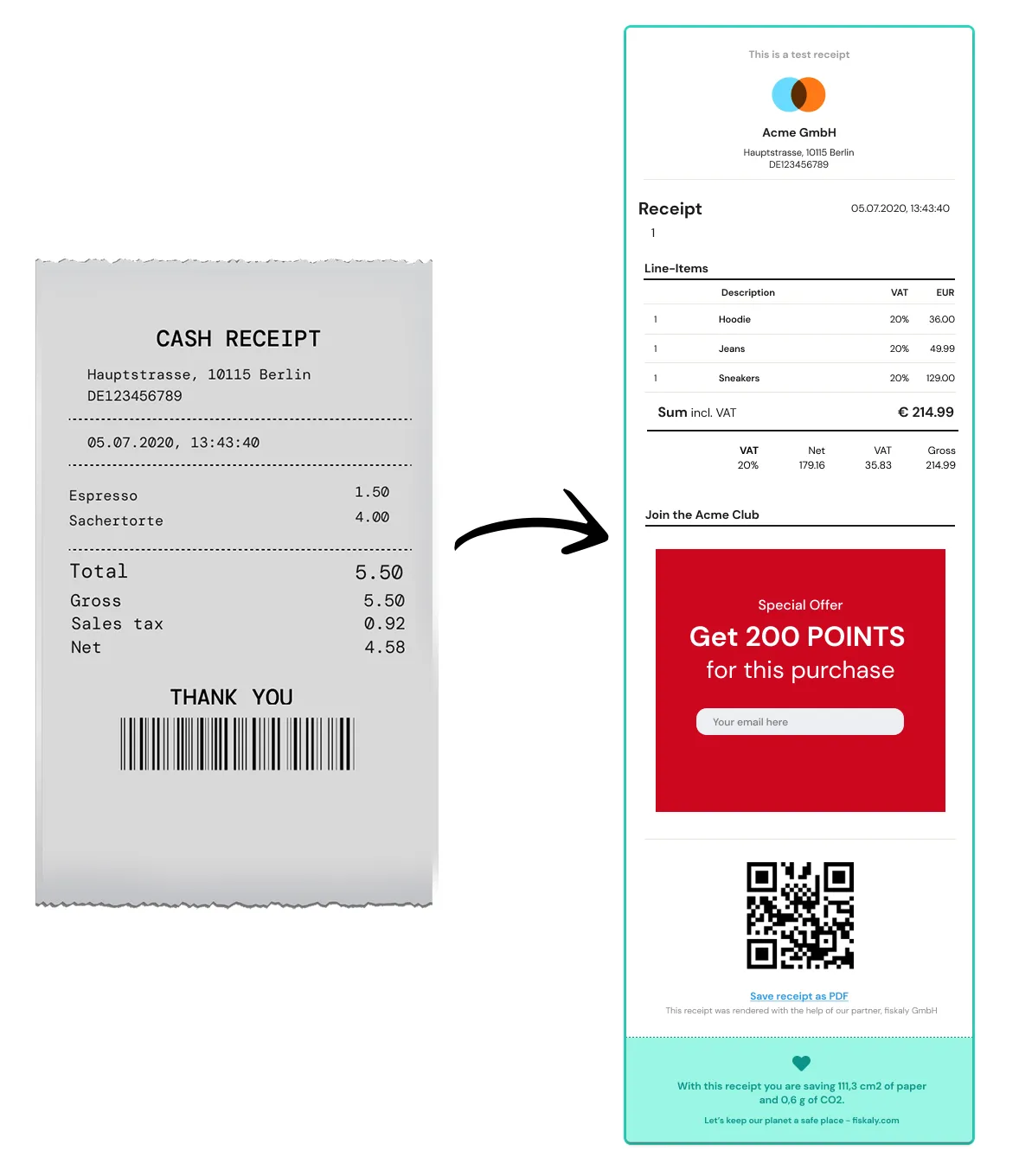

Various use cases of the digital receipt

After completing a transaction, receipts are issued to the buyer as a confirmation, overview, and warranty document. In many countries, the so-called receipt or voucher issuance is mandatory. Digital receipts cover these obligations while providing a variety of benefits compared to traditional paper receipts.

Customizable branding for retailers

Imagine buying a shirt for 500€ and receiving a cluttered or unaesthetically designed receipt. This subtle customer touch point most likely distorts or even damages your image of this premium brand. Individual branding of the receipt should never be underestimated. A uniformly designed brand experience, right down to the smallest detail, pays dividends in terms of positive consumer perception. And it does so in all segments - not just the luxury one.

Dynamic advertising, even on issued receipts

Consumers find either no product advertising/promotions or outdated ones on traditional paper receipts. It is possible to fill advertising spaces with dynamic content and show customized advertising to the consumer on digital receipts. This way, an already issued digital receipt can contain up-to-date advertising even after several years.

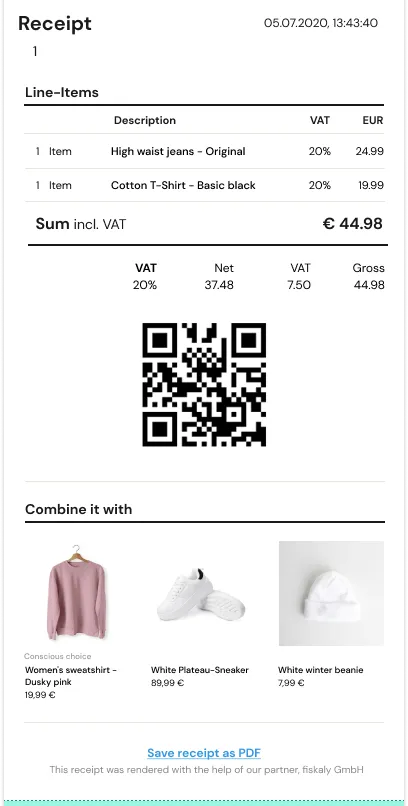

Online marketing for offline stores

Integrating additional advertising space is no problem on digital receipts. Think of online retail, which has been using the purchase recommendation option as a successful model for years. Especially outside the area of fast-moving products, such as fashion or consumer goods, receipts are more carefully stored for warranty or a return of the product, this option can be used profitably. Why not recommend a matching beanie when someone buys a winter jacket?

Accelerated receipt issuance for hospitality businesses

There is often only one cash register for the entire establishment at many hospitality venues. Although mobile devices are used for staff receipting, the only existing cash register must often be used for receipt issuance. This leads to unnecessary additional ways for the waiter/waitress and longer waiting times for guests. Issuing receipts directly via the mobile device's display using a QR code simplifies the process for the waiter/waitress, and improves the customer experience significantly.

Shortened payment path for services providers

In Germany, the percentage of company cars among all registered cars is consistently around 10%, roughly 5.15 million cars. Those vehicle owners know how tedious the administration of paper receipts for the additional refueling fees is. Issuing a digital receipt - preferably right at the gas station - with a direct forwarding to the accounting software (or app) creates efficiency for several parties in the company at once.

Reduced waiting times

Have you ever waited a long time in a cab for a printed receipt to be issued? Sometimes the receipt printing takes as long as a third of the ride itself. Digital receipts provide a remedy in this case. QR codes can be made available in every cab and significantly speed up the receipt issuance process. Also in this case the receipt can be automatically forwarded to the linked accounting department upon receiving the receipt or keep it safe in your Google Wallet or Apple Wallet.

Mobile services

Many services, such as massages or physiotherapy treatments, can be consumed at home. But how is the receipt issued afterwards? Like in a cab, the consumer must wait a long time for the receipt to be printed out. Not with digital receipts! In this application, the service provider can also offer a QR code that simplifies and speeds up the issuing process.