Certification of POS systems in France: What software vendors need to know

Certification of POS systems in France: What software vendors need to know

Operating a POS system in France means complying with strict fiscal rules and controls. Since 2018, every cash register software must meet anti-fraud requirements pursuant to Article 286 of the General Tax Code (CGI), often linked or referred to the NF525 standard. But with the February 2025 Finance Law, the requirements have evolved, and certification has become essential for vendors.

In this article, we’ll explore what this means for cash register system providers already active in France or planning to enter this market.

Key points for POS software and systems

- From September 1, 2026, only certified cash register software will be allowed, strengthening the fight against VAT fraud.

- Non-compliance with certification requirements may result in fines of up to €7,500 per register, as well as severe legal sanctions.

- fiskaly offers tailored solutions to help merchants and their clients comply with certification requirements, ensuring the security and integrity of transactions.

End of self-certification: what’s changing

Until recently, vendors could issue a self-declaration of compliance for their POS software. This option disappears with the 2025 Finance Law.

From September 2026, every certified cash register will have to go through an accredited body (for example, LNE). Self-certifications will no longer be recognized.

International software vendors therefore need to anticipate an official audit and obtain a valid cash register software certification from an external certification body.

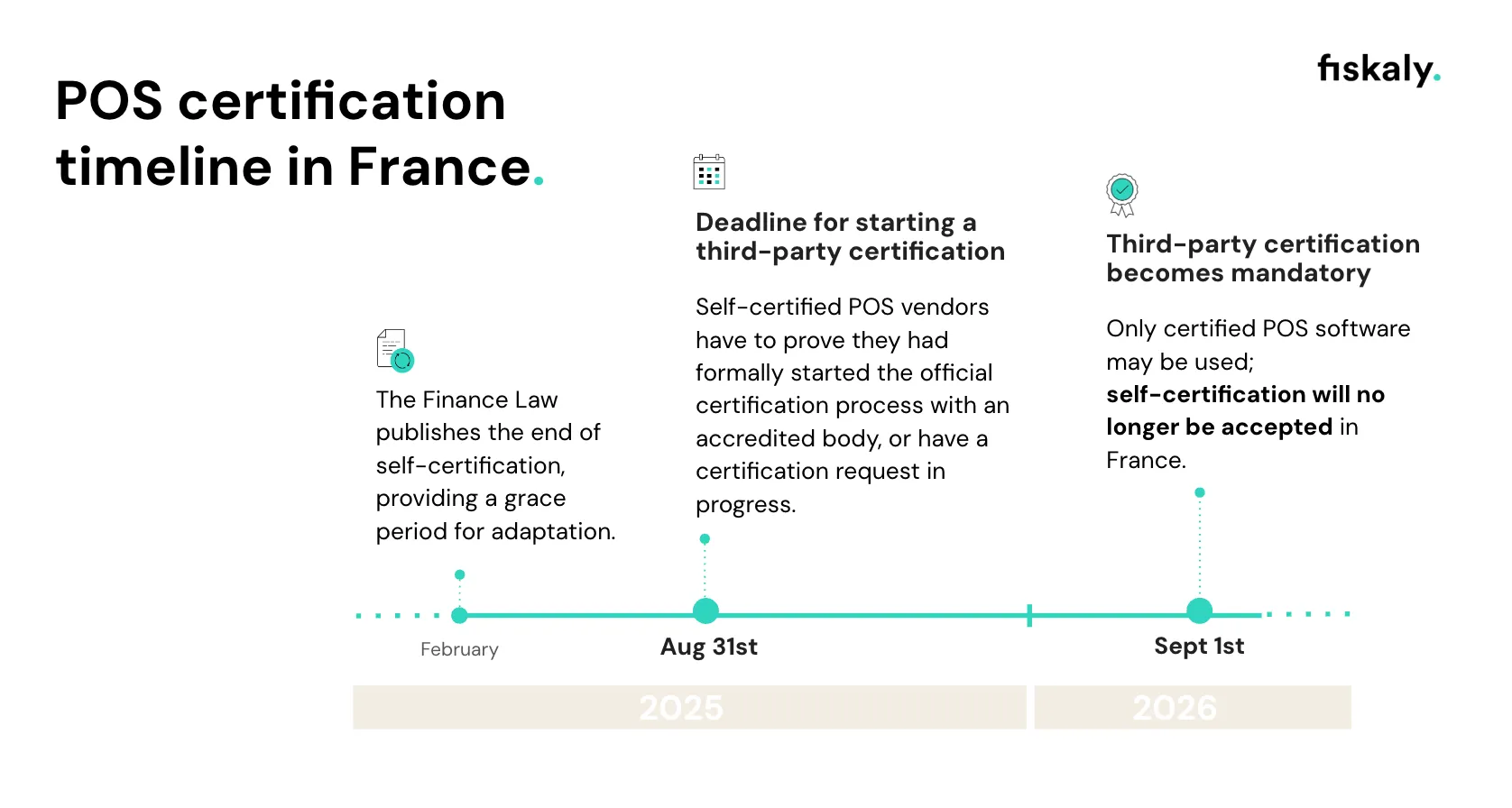

Certification timeline in France

February 16 – August 31, 2025: deadline to move from self-attestation to third-party certification

During the transition period, businesses could demonstrate compliance by using a certificate provided by their software vendor. However, for this to be valid, the vendor had to prove they had formally started the official certification process with an accredited body, for example, by signing a contract, accepting a quote, or placing a firm order.

👉 If you missed this deadline, contact us: we’ll help you start the process as soon as possible.

September 1, 2025 – August 31, 2026 POS software and cash register systems must either:

- already have a cash register certification from an accredited body, or

- have a certification request in progress

From September 1, 2026

Only certified POS software may be used; self-certification will no longer be accepted in France.

⚠️ Originally, the February 2025 law mandated that only certified POS software could be used starting March 1, 2026. However, on October 1, 2025, French authorities announced a deadline extension until August 31, 2026.

Technical requirements for POS systems, simplified

Certification for POS software and systems is based on four principles, commonly called ISCA: requirements for unalterability, security, retention, and archiving.

- Inalterability: calculate daily, monthly, and annual closings, and keep both period grand totals and perpetual totals. Hash, sign, and journal all records to ensure tamper-evident integrity and prevent undetected changes.

- Conservation: records must be stored for 6 years, extended to 7 when the fiscal year is off-calendar.

- Archiving: data must be exportable in a secure and readable format for audits

- Security: each transaction must be protected by digital signature or hashing, allowing verification

This means that every certified POS software must include tamper-proof logs, immutable reports, digital seals, and a standardized export function.

The software certification process: are LNE certification and NF525 certification the same?

To obtain POS software certification, two main options exist:

- LNE certification, issued by the Laboratoire National de Métrologie et d’Essais

- NF525 certification, managed by AFNOR/InfoCert

Both validate the same legal requirements, but each of the certification bodies has their own standards, therefore their requirements and certification processes differ. The process includes:

- Submitting documentation showing how the software meets the technical requirements

- Undergoing functional and technical tests performed by the certifying body

- Receiving the certificate of conformity

Once obtained, your certified cash register software is officially recognized as compliant by the French tax administration.

Risks of non-compliance

The consequences are serious:

Merchants: fines of €7,500 per non-compliant register, renewed until the issue is resolved

Software vendors: penalties of up to 15% of revenue generated from non-compliant solutions

Criminal liability:

- Forging a document is a crime (Article 441-1 of the French Penal Code): up to 3 years in prison and a €45,000 fine

- Foreign vendors who provide fake certificates to French businesses are also liable

- VAT payers who knowingly present a fake certificate to the authorities face the same penalties

In practice, entering the French market without certified POS software is impossible from now on.

How to stay compliant easily with fiskaly

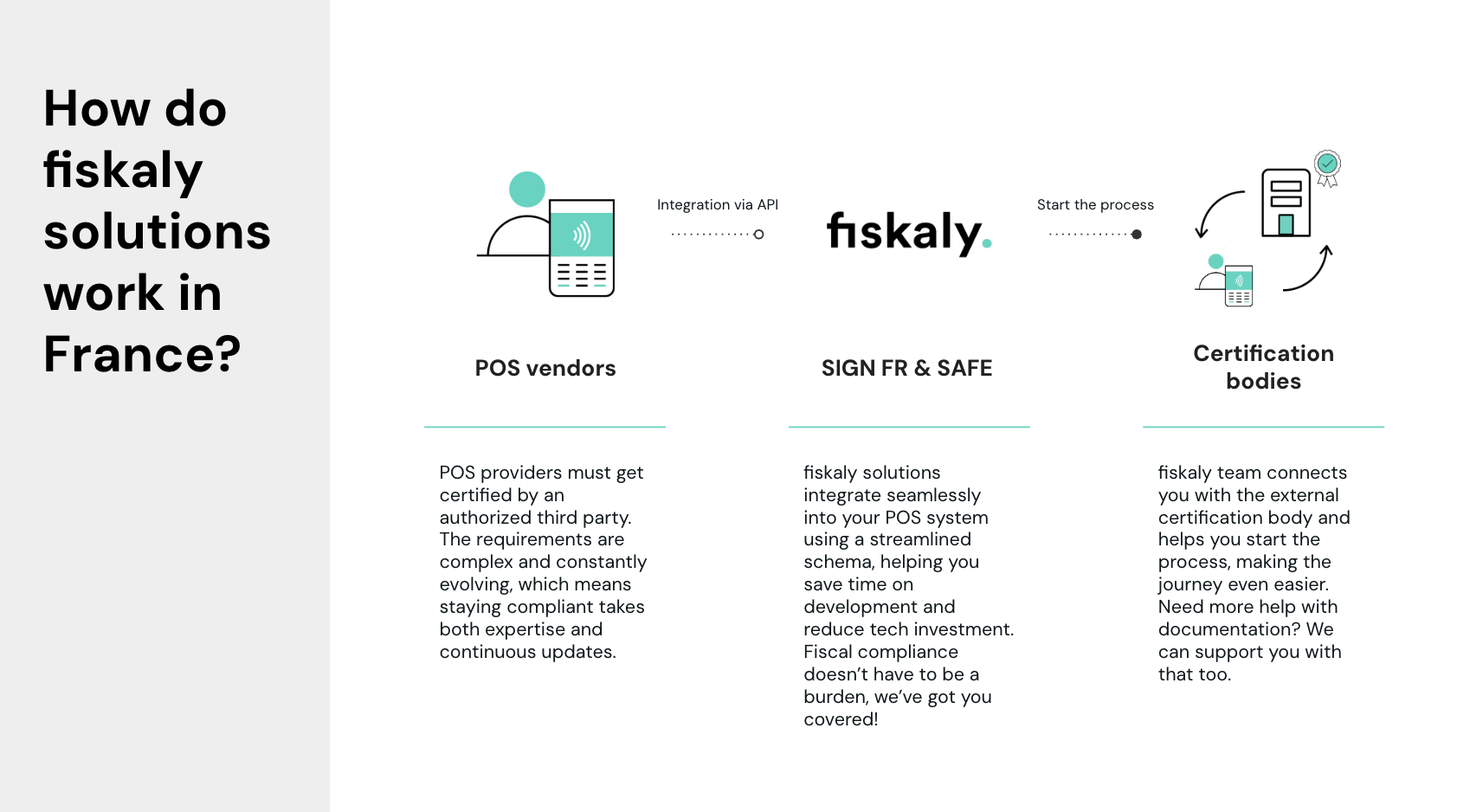

At fiskaly, we help software vendors and their clients meet these obligations without technical complexity. Our solutions fiskaly SIGN FR and fiskaly SAFE provide the infrastructure needed to ensure compliant and secure transaction management.

- fiskaly SIGN FR: every transaction is digitally signed and protected against alteration, guaranteeing inalterability and security

- fiskaly SAFE: storage, retention, and archiving in line with fiscal standards, ready for audits

With our cloud services, you can more easily obtain LNE certification and access the French market with confidence.

Ready to certify your POS software in France?

The countdown has started. With the end of self-certification, only external cash register certification will be valid.

Whether you’ve heard of LNE certification, NF525 certification, NF525 norm, cash register certification or certified cash register software... It doesn't matter how you call it, fiskaly helps you comply with the legal requirements and focus on scaling your business, taking the compliance load off your shoulders.

👉 Contact us to learn how fiskaly SIGN FR and SAFE can prepare your cash register system for certification in France, giving your clients a solution fully compliant with fiscal control requirements.

Our mission is to make fiscalization simple, transparent, and reliable for software vendors who want to operate in regulated markets.

We are already a trusted partner for many POS providers across Europe. fiskaly operates in Germany, Austria, Spain, and Italy, where our services are certified and used daily by thousands of merchants. With over 1 million POS terminals powered by fiskaly solutions, we bring expertise and proven stability to every market.

👇 Let's talk about how fiskaly can help you obtain certification in France quickly.